The five stages of planning for a successful retirement

- Noel Watson

- Oct 13, 2021

- 5 min read

Updated: Oct 15, 2024

Introduction

People seeking financial advice and retirement planning often ask:

'What’s the best fund to invest in?'

'Can you get me great returns?'

'How can I maximise tax-efficient investments?'

'Can you review my pensions and investments?'

These are all important questions (and should be addressed by a competent financial adviser), but they are probably the wrong starting point when considering retirement planning.

The financial adviser community is partly to blame for this. Historically, in a crowded marketplace, financial advisers have attempted to increase sales by differentiating their financial products* from alternative offerings, such as by highlighting their star fund managers and superior performance.

If you were to build a house, you could not construct and fit the roof without first making the foundations and walls. Similarly, we believe you shouldn’t begin to consider selecting the best financial products until you have built up a picture of what you want to achieve (Life Planning) and the most efficient way to achieve it (Financial Planning).

Happily, with time, the focus of the more forward-thinking financial advisers has shifted from financial products to the person and financial planning as investment management has become increasingly commoditised. Based on this approach, we believe there are five steps you need to undertake to ensure you give yourself the best chance of retirement success, and we provide an overview of the process below:

Stage One: Person (Life Planning): Establishing the cost of your current and future desired lifestyle.

Many people could stop working tomorrow and live off a small income in a remote, undeveloped country, but this may not be what you seek.

It's worth spending some time thinking about the following:

The cost of your current lifestyle: How much you are spending now. The outcome of this stage can be used as a baseline for the following stages:

Survivor's expenditure: How much the remaining family members would spend if you (or your partner) were to die tomorrow?

Early financial independence expenditure: What will change compared to current spending? For example, commuting costs may disappear!

Post 70/80 expenditure: Spending may reduce later in life, and your numbers should reflect this.

Care fees provision: You may want to consider budgeting for this.

Big-ticket items: For example, a 'round the world' trip you’ve always promised yourself, or maybe helping the children with house deposits.

A spreadsheet to assist with this can be downloaded from the 'Planning for Retirement: Your Guide to Financial Freedom' website.

A screenshot is shown below.

Stage Two: Plan (Financial Planning): Building a financial plan to evaluate the feasibility of your goals.

Once you have established the cost of your current and future lifestyle, you then need to determine how this will be funded. Items to consider include:

Workplace income: How much do you estimate you will earn in total before you retire?

Investment income: This includes things like pensions, ISAs, cash, etc.

State pensions: Your state pension forecast can easily be checked.

You will need to make assumptions around longevity, investment growth and inflation.

Again, you can download a spreadsheet from the book's website to help with Stage Two – a couple of screenshots are shown below.

Stages One and Two are typically iterative – it may be that the first draft of the financial plan shows you running out of money at a relatively young age. Alternatively, your financial plan might show a high investment balance upon death (you are the richest person in the graveyard!) – neither is ideal.

During this process, you should optimise lifetime taxation (including income, capital gains, and inheritance tax).

In addition, you may want to consider creating some child scenarios to evaluate the less fortunate outcomes. For example, would the plan still succeed if the primary breadwinner were to die tomorrow?

Stage Three: Portfolio (Financial Products): Creating an investment 'engine' to deliver the returns your financial plan requires.

Once you have a robust financial plan, you must build an investment engine to deliver the returns necessary to ensure your financial plan succeeds.

When constructing the framework of a retirement portfolio, future income can broadly be broken down into two streams:

Secure: Income paid at a reliable, predefined level and is unaffected by market volatility or investment returns.

Non-secure: Income potentially impacted by investment/market returns.

You will need to consider how much secure income (state pension etc.) you can expect to receive and whether you would like this to cover the basics such as food and heating. For non-secure income, you will need to find an acceptable compromise between:

1. How much risk are you happy taking (how far can you accept your portfolio falling during volatile markets without feeling the urge to capitulate and sell)?

2. Taking enough risk to ensure you don’t run out of money in retirement.

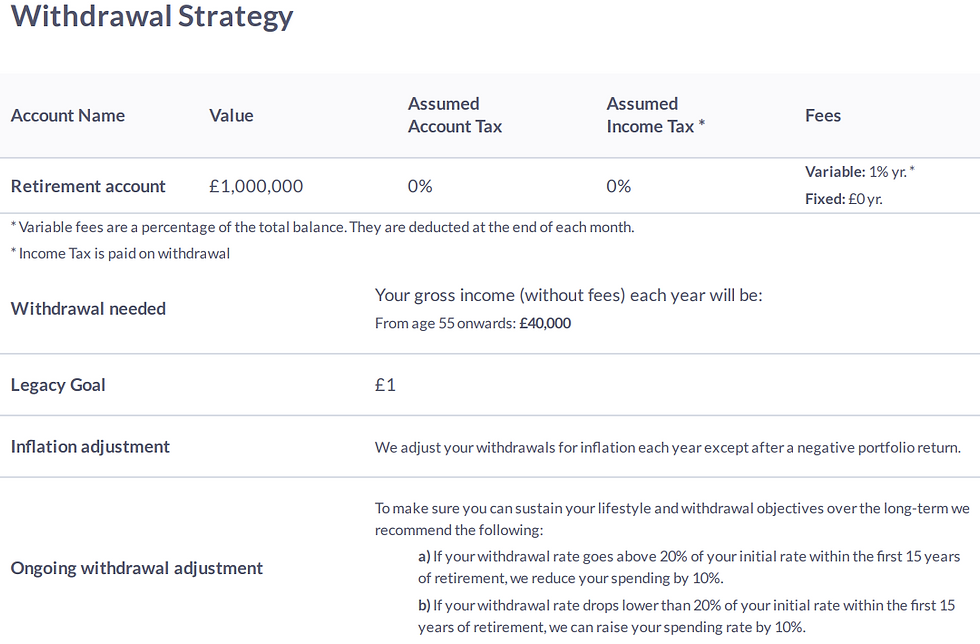

Stage Four: Withdrawal strategy: Constructing a withdrawal strategy and the various 'levers' that can impact your plan sustainability.

This step involves creating a strategy that will ensure your retirement plan can deal with extreme market events that we have historically experienced. You will need to consider what levers you may need to use to enhance plan success, both at the outset and also if volatile markets are encountered along the way. This withdrawal strategy should be detailed in a withdrawal policy statement – an example Withdrawal policy statement is shown below and can be downloaded from the book's website.

Stage Five: DIY or pay for financial advice: Deciding between a DIY approach or working with a financial adviser.

The final step is to decide whether you want to plan your retirement on a DIY basis or hire a financial adviser. Undertaking your own retirement planning might be something that you would enjoy, given the necessary time, confidence, and knowledge. Your affairs may be relatively simple, or the size of your retirement investments means that paying for financial advice would not be worthwhile. You might also feel that the ongoing challenge and process will help keep your brain sharp after the mental stimulation from working life ceases, and you are confident that you won't blow up your retirement plan.

Alternatively, you may choose to work with a financial adviser. You will need to consider how to find the financial adviser best suited to your retirement planning needs and understand how much a financial adviser will cost. It might be worth building a list of potential financial advisers and filtering this down until you find the perfect fit for you - an example is shown below and once again is available from the book's website.

* Financial Product: Financial products are things such as pensions, ISAs, bonds, and investment funds. They are tools in the toolbox that enable us to achieve our financial and retirement goals.

Conclusion:

The above demonstrates the importance of adopting a systematic approach when planning for retirement and ensuring that each stage is undertaken in the correct order. Furthermore, it highlights that fund selection can only occur once a robust financial plan is in place.

Want to find out more?

If you want to learn more about building a robust retirement plan, please schedule a free, no-obligation call.

About us

The team at Pyrford Financial Planning are highly qualified Independent Financial Advisers based in Weybridge, Surrey. We specialise in retirement planning and provide pension advice, investment advice and inheritance tax advice.

Our office telephone number is 01932 645150.

Our office address is No 5, The Heights, Weybridge KT13 0NY

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Although best efforts are made to ensure all information is accurate, you should not rely on this blog for your personal situation or planning.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Comments